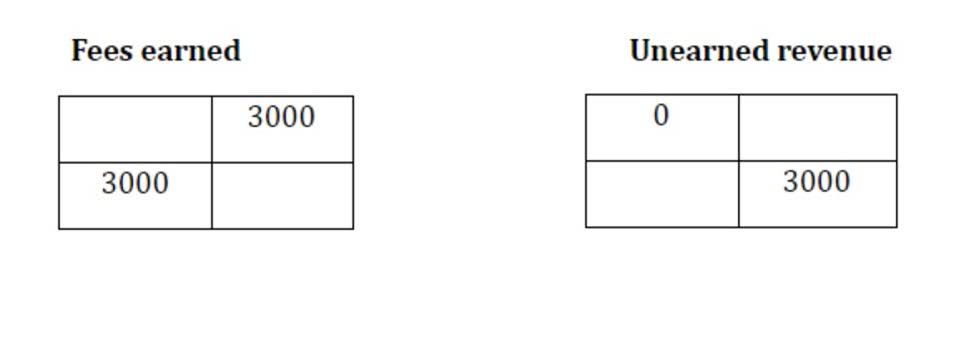

If a company provides a service and gives the client 30 days in which to pay, the company’s Service Revenues account and Accounts Receivable are affected. It is necessary for them to always be in balance with one another. T-Accounts always record entries in the same fashion, with “debits” on the left and “credits” on the right.

- For different account types, a debit and a credit may increase or decrease the account value.

- The T-account instructs bookkeepers on how to pass the data into a ledger to achieve an adjusted balance, which ensures that expenses equal revenues.

- Each journal entry must have the dollars of debits equal to the dollars of credits.

- Under the accrual basis of accounting, the matching is NOT based on the date that the expenses are paid.

- Generally, expenses are debited to a specific expense account and the normal balance of an expense account is a debit balance.

What are T accounts? – Comprehensive Guide

It can handle everything from writing formulas and cleaning data to creating visuals like dashboards and reports. It automates the heavy lifting, allowing you to focus on making informed decisions based on your data. In this article, we’ll walk through the process of setting up T Accounts in Excel step-by-step. Whether you’re an accounting student, a small business owner, or just someone interested in Certified Public Accountant managing finances better, you’ll find this tutorial helpful.

Double Entry Bookkeeping

On the left-side of the vertical line, the debit amounts are shown. For example, if you examine the T-account above, you can see that all increases to the bank account (receipts) occur on the left side. All the decreases to the bank account (payments) occur on the right side. Remember that with every transaction and journal entry there will be two accounts that are affected. The source of this increase to the bank account is capital – the owner investing in the business. Before the days of accounting software, bookkeepers and accountants actually kept physical books, and each ledger was a separate physical book.

Liabilities

The amount in every transaction must be entered in one account as a debit (left side of the account) and in another account as a credit (right side of the account). This double-entry system provides accuracy in the accounting records and financial statements. All increases to Accounts Receivable are placed on the debit side (since it is an asset account). Total debits amount to $320,000 while total credits amount to $230,000.

How Are T Accounts Used in Accounting?

Posting of these debit and credit transaction to the individual t-accounts provides for an accurate visualization technique for knowing what is happening in each individual account. It provides the management with useful information such as the ending balances of each account which they can then use for a variety of budgeting or financial purposes. The opposite of what increases the account balances will hold to decrease those accounts.

- This is where T accounts come in as a bridge between the raw data and meaningful insights.

- Accounts Receivable is an asset account and is increased with a debit; Service Revenues is increased with a credit.

- It’s not just a number; it’s a reflection of your business’s financial health and market positioning.

- The right side (credit side) is conversely, a decrease to the asset account.

- It is one of the best ways to keep debits and credits straight, visually.

- Likewise, accounts with a credit balance, like liabilities, will always increase when another credit is added to the account.

This process begins with journal entries, which include the transaction date, description, and debit and credit amounts. These entries are then posted to the appropriate T accounts to track changes in balances. A single entry system of accounting does not provide enough information to be represented by the visual structure a T account offers. This is shown in ledger or T-accounts by recording each transaction twice, once what are t accounts as a debit-entry in one account and once as a credit-entry in another account.

If the revenues come from a secondary activity, they are considered to be nonoperating revenues. For example, interest earned by a manufacturer real estate cash flow on its investments is a nonoperating revenue. Interest earned by a bank is considered to be part of operating revenues. For example, when a company borrows $1,000 from a bank, the transaction will affect the company’s Cash account and the company’s Notes Payable account. When the company repays the bank loan, the Cash account and the Notes Payable account are also involved.

Individuals Filing Taxes

Property management accounting is simply the financial process involved in managing rental properties. I now have three month’s worth of rent paid for, so my prepayments (prepaid rent) account is debited £6000. Rent is classed as an operating cost as it’s a standard cost required to run my business. Operating costs are a type of expense so it is debited by £2000.

On the other hand, t the account must be credited o increase ABC’s Notes Payable account, since it is a liability account. For different account types, a debit and a credit may increase or decrease the account value. T accounts offer simplicity and clarity in recording and analyzing transactions. They provide a visual representation that helps users understand the impact of transactions on individual accounts and overall financial health. Yes, T accounts can be used for all accounts, including assets, liabilities, equity, revenues, and expenses. Each account has its T account to record transactions specific to that account.